Energy logistics

The role of maritime transportation

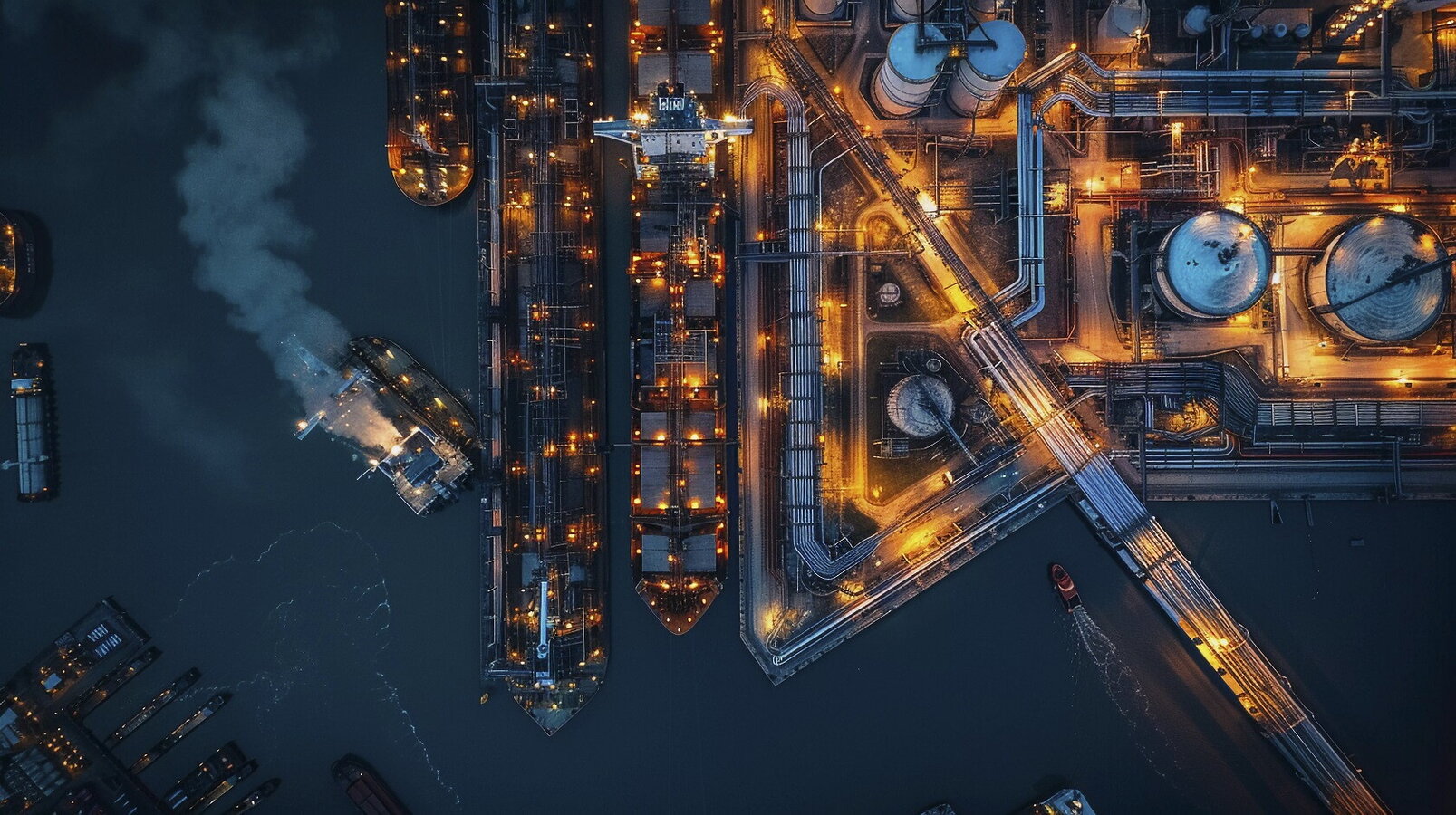

Current geopolitical tensions and the trade war between the United States (U.S.) and China are impacting global energy logistics. Shipping times and costs have increased, reducing traffic through the main global chokepoints

5 minToday’s energy logistics mirror shifting geopolitical power balances —now under intensified strain from disruptive global events. The inauguration of a new U.S. administration has ignited a fresh trade war, compounding the instability already generated by two ongoing military conflicts.

The Make America Great Again (MAGA) platform, with its emphasis on energy independence, is redrawing the global energy map. This push is rooted in a paradox: while the U.S. is largely self-sufficient in fossil fuels, it remains deeply reliant on imports of critical raw materials essential for clean energy technologies. Solar panels, batteries, and wind turbines depend on components sourced almost entirely from Southeast Asia or China. For wind turbines alone, steel and aluminum make up roughly 85 percent of total weight —materials that are increasingly entangled in geopolitical tension.

These dependencies are now flashpoints in a broader trade conflict. The resulting uncertainty threatens to stall investment, inflate costs, and undermine long-term energy security.

Although their final form remains uncertain, the new tariffs are already reshaping global energy flows—not just for fossil fuels, but for renewables as well. The initial shock came on Liberation Day, when sweeping restrictions were imposed on a long list of countries. Most of those measures were later suspended, opening the door to negotiations. Early trade deals with the White House have since helped ease tensions—but only partially.

Routes and chokepoints

Today’s landscape is shaped by ongoing trade negotiations and their expected impact on economic growth —and by extension, commodity demand. Commodities are once again a central concern, with implications for port operations and global shipping routes. These routes have already been upended by Houthi attacks in the Red Sea, forcing detours around the Cape of Good Hope. Shipping companies have had to reschedule and reroute voyages, resulting in substantial delays and a sharp rise in costs —freight, insurance, and crew among them. For the energy sector, this disruption has raised serious concerns about the reliability of supply chains.

Armed conflict has also reshaped the flow of global commodities through key maritime chokepoints. The Strait of Hormuz now handles 27 percent of global oil and gas trade. The Strait of Malacca carries about 33.5 percent of crude oil, 13 percent of refined products, 15.1 percent of gas, and 17 percent of LNG. The Suez Canal —once a vital corridor for crude oil, refined products, and gas— has seen a steep drop in traffic. Before the current crisis, it handled 10 percent of global oil products and 8 percent of LNG shipments. Those figures have since fallen to 5 percent and 1.2 percent, respectively. LNG tanker transits have dropped 90 percent compared to 2023 averages, and oil tanker traffic is down by 40–50 percent.

Geopolitical tensions are also disrupting ports and the wider logistics system —critical links in the global supply chain for fossil fuels.

Ports have long served as energy gateways —hosting fossil fuel terminals, pipeline endpoints, and hubs for the import and export of oil, refined products, and LNG. They are typically located near energy-intensive industries. Now, ports face a dual mandate: maintain their critical role in energy logistics while adapting to the green transition. This shift is transforming many into smart, low-emissions hubs. In Italy, where energy accounts for 35 percent of total port activity, the implications are particularly significant.

The Challenge of sustainability

Several Italian ports already rank among the top energy hubs in the Mediterranean, particularly in oil and derivatives. But their future role is shifting. As the energy transition accelerates, these ports are becoming central to decarbonization strategies. By adopting cleaner fuels, building out renewable energy projects—solar, wind (including offshore), hydrogen—and investing in cold ironing, ports can reduce emissions and serve as a testbed for sustainable logistics. Energy Communities based in ports can extend benefits to nearby industrial zones. New infrastructure, such as LNG terminals and bunkering for alternative fuels, will reinforce both energy security and the transition away from fossil fuels.

Research from the SRM study center underscores the shift: sustainable development is no longer optional but strategic. In a fast-changing landscape, ports must move beyond passive adaptation. They will need to lead—driving innovation, pursuing sustainability, and accelerating digitalization. Those that succeed will cement their position as core engines in the emerging energy geography.